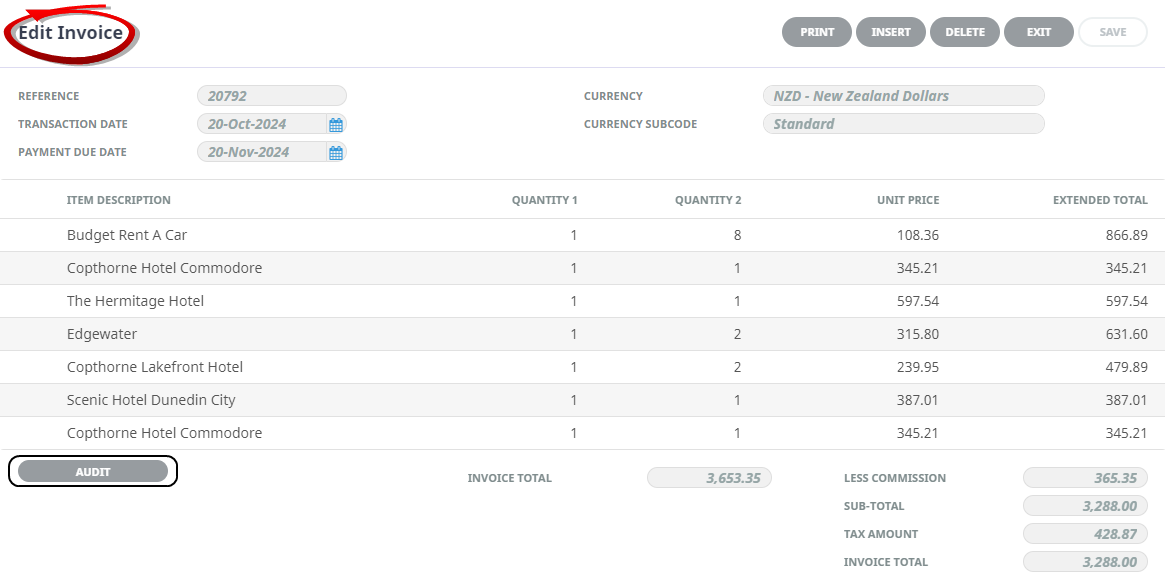

When a transaction has been selected from the transaction list, an Audit button is available on the transaction screen dialogue to perform a low level enquiry on the transaction.

NOTE: The label on the screen dialogue depends on the type of transaction:

- Invoice - label Edit Invoice.

- Credit Note - label Credit Note.

- Receipt - label Edit Receipt.

- Unallocated Cash - label Unallocated Cash.

View Transaction Audit

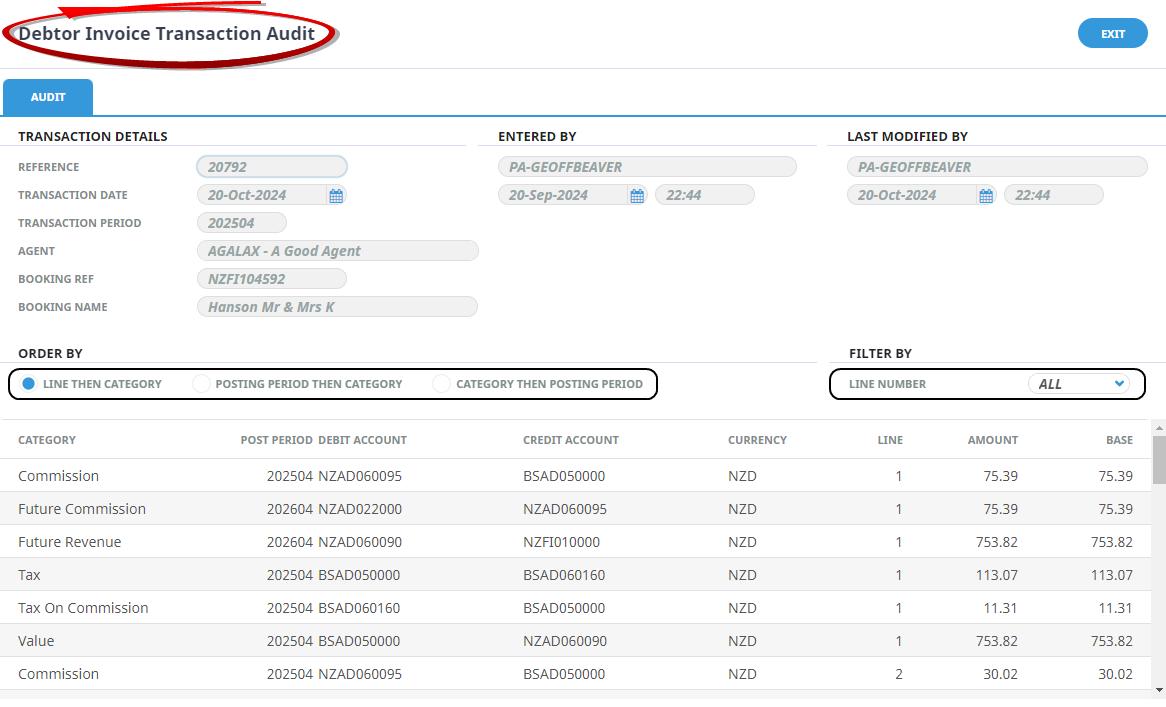

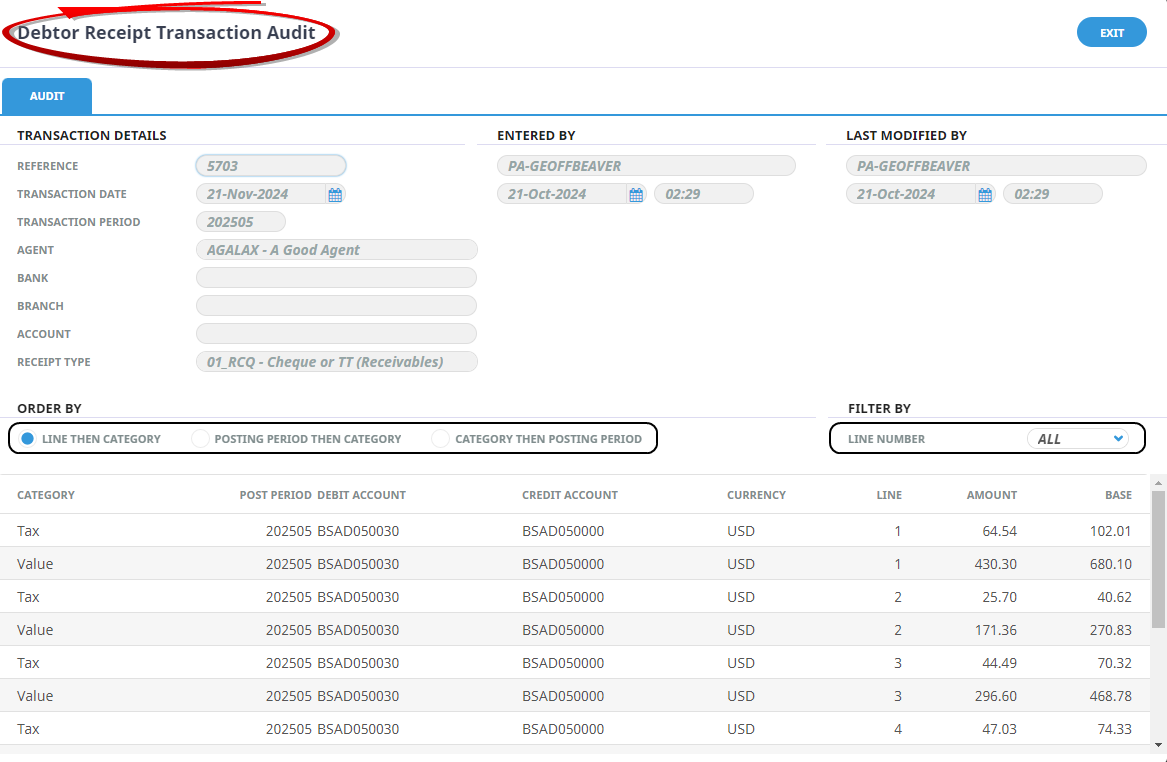

NOTE: The only fields that can be accessed in the Audit displays are 'Order By' and 'Filter By', which enable the records to be filtered and sorted on screen. All other fields are display only.

-

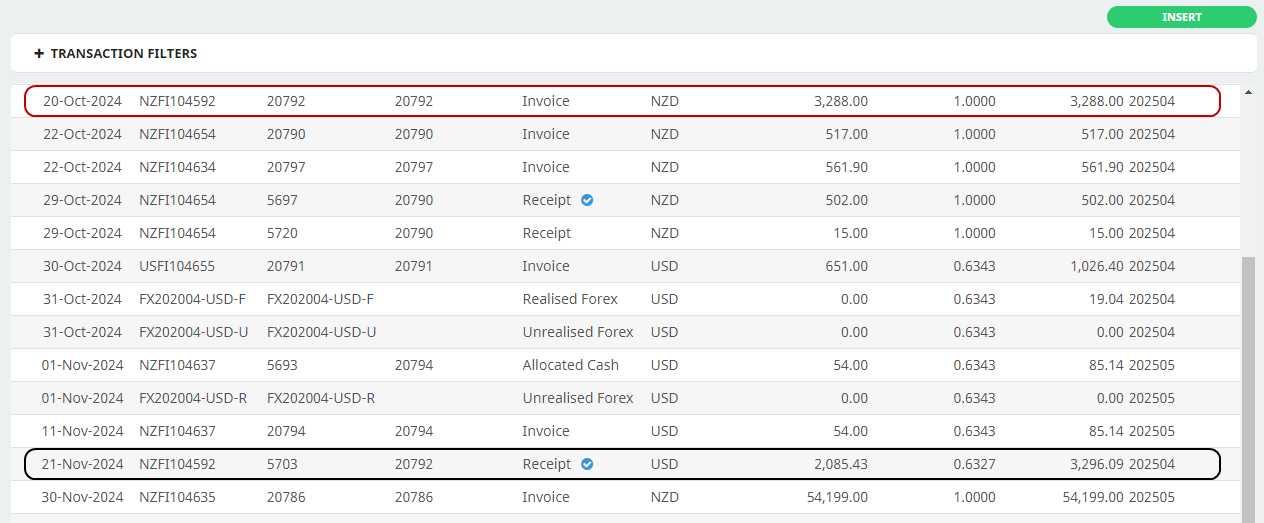

Open the Debtor Transaction Screen from the Debtors Menu. Select

Main Menu > Financials > Accounting > Transactions.

Main Menu > Financials > Accounting > Transactions.

-

Click the transaction line to open.

Two examples shown; an invoice transaction (in red) and the subsequent receipt transaction (in black).

- Click the Audit Button to open the Transaction Audit screen.

Regardless whether the transaction being queried is in an Open or Closed accounting period, the dialogue label shows "Edit (Invoice, Receipt etc). When the transaction is in a closed period, all fields are dimmed out.

Regardless whether the transaction being queried is in an Open or Closed accounting period, the dialogue label shows "Edit (Invoice, Receipt etc). When the transaction is in a closed period, all fields are dimmed out.

About the Debtor Invoice Transaction Audit Screen

The Order By radio buttons can be used to change the order of the on-screen display. The options are:

- By transaction line number, then transaction line category (default setting).

- By line posting period, then line category.

- By line category then line posting period.

The Filter drop-down can be used to filter the audit by All (default) invoice lines or specific invoice line.

Transaction Details Section

Reference

Transaction reference number.

Transaction Date (Date)

Transaction date.

Transaction Period

Transaction period (TRP).

Agent

The Debtor / Agent code and name.

Booking Ref

The invoiced bookings Booking Reference.

NOTE: This field is blank for Non Booking invoices.

Booking Name

The invoiced bookings Booking Name.

NOTE: This field is blank for Non Booking invoices.

Entered By / Last Modified By Sections

First Field

The user name.

Second Field (Date & Time)

The date and time of transaction creation, and the date and time of its' last modification.

Other Key Terms

- Category - The description of the line category.

- Post Period - The G.L. posting period (GLP).

- Debit Account - The. G.L. Account debited with the line amount.

- Credit Account - The G.L. Account t credited with the line amount.

- Currency - The Currency of the transaction.

- Line - The Transaction Line Number.

- Amount - The line amount in transaction currency.

- Base - The amount in system base currency.

About the Debtor Receipt Transaction Audit Screen

The Order By radio buttons can be used to change the order of the on-screen display. The options are:

- By transaction line number, then transaction line category (default setting).

- By line posting period, then line category.

- By line category then line posting period.

The Filter drop-down can be used to filter the audit by All (default) invoice lines or specific invoice line.

Transaction Details Section

Reference

Transaction reference number.

Transaction Date (Date)

Transaction date.

Transaction Period

Transaction period (TRP).

Agent

The Debtor / Agent code and name.

Entered By / Last Modified By Sections

First Field

The user name.

Second Field (Date & Time)

The date and time of transaction creation, and the date and time of its' last modification.

Other Key Terms

- Category - The description of the line category.

- Post Period - The G.L. posting period (GLP).

- Debit Account - The. G.L. Account to be debited with the line amount.

- Credit Account - The G.L. Account to be credited with the line amount.

- Currency - The Currency of the transaction.

- Line - The Transaction Line Number.

- Amount - The line amount in transaction currency.

- Base - The amount in system base currency.